An Unbiased View of Medicare Graham

An Unbiased View of Medicare Graham

Blog Article

A Biased View of Medicare Graham

Table of Contents5 Easy Facts About Medicare Graham ExplainedSome Known Factual Statements About Medicare Graham How Medicare Graham can Save You Time, Stress, and Money.The Greatest Guide To Medicare GrahamA Biased View of Medicare GrahamNot known Factual Statements About Medicare Graham Medicare Graham for Dummies10 Simple Techniques For Medicare Graham

In 2024, this threshold was evaluated $5,030. Once you and your plan spend that amount on Part D medications, you have actually gotten in the donut opening and will certainly pay 25% for medications going ahead. When your out-of-pocket expenses reach the 2nd limit of $8,000 in 2024, you run out the donut hole, and "tragic insurance coverage" begins.In 2025, the donut hole will be mainly eliminated for a $2,000 restriction on out-of-pocket Component D drug spending. Once you hit that threshold, you'll pay nothing else out of pocket for the year. If you only have Medicare Components A and B, you could think about supplemental exclusive insurance to assist cover your out-of-pocket costs such as copays, coinsurance, and deductibles.

While Medicare Part C functions as an option to your original Medicare strategy, Medigap works together with Parts A and B and helps fill out any type of insurance coverage gaps. There are a couple of vital things to find out about Medigap. You need to have Medicare Parts A and B before acquiring a Medigap plan, as it is a supplement to Medicare and not a stand-alone plan.

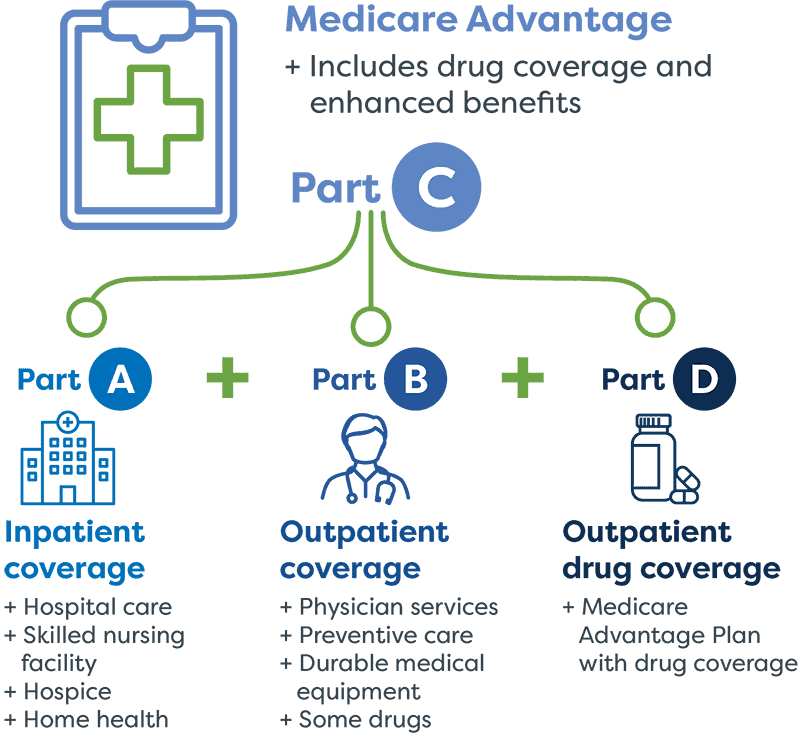

Medicare has actually evolved over the years and now has 4 parts. If you're age 65 or older and get Social Safety and security, you'll instantly be signed up partly A, which covers a hospital stay costs. Parts B (outpatient services) and D (prescription medicine advantages) are voluntary, though under certain scenarios you might be instantly enrolled in either or both of these.

The Ultimate Guide To Medicare Graham

This article explains the kinds of Medicare intends available and their protection. It also offers advice for individuals who look after household members with specials needs or wellness problems and dream to manage their Medicare events. Medicare consists of four parts.Medicare Part A covers inpatient healthcare facility care. It likewise includes hospice care, experienced nursing facility treatment, and home medical care when a person fulfills certain requirements. Monthly costs for those that require to.

acquire Part A are either$285 or$ 518, relying on the amount of years they or their partner have paid Medicare taxes. This optional insurance coverage requires a regular monthly costs. Medicare Part B covers medically needed solutions such as outpatient physician visits, diagnostic solutions , and precautionary services. Exclusive insurers market and provide these policies, yet Medicare needs to approve any Medicare Benefit strategy prior to insurance companies can market it. These strategies provide the very same insurance coverage as components A and B, however many additionally consist of prescription drug insurance coverage. Regular monthly premiums for Medicare Benefit prepares have a tendency to rely on the area and the plan a person selects. A Part D plan's insurance coverage depends on its price, drug formulary, and the insurance provider. Medicare does not.

The 3-Minute Rule for Medicare Graham

commonly cover 100 %of medical prices, and the majority of plans call for a person to meet an insurance deductible prior to Medicare spends for clinical services. Part D commonly has an income-adjusted premium, with higher costs for those in greater earnings braces. This relates to both in-network and out-of-network healthcare specialists. Out-of-network

The 2-Minute Rule for Medicare Graham

care incurs treatment sustainsAdded For this kind of plan, administrators determine what the insurance firm spends for medical professional and health center insurance coverage and what the strategy owner should pay. A person does not require to pick a medical care doctor or acquire a recommendation to see a specialist.

Medigap is a single-user policy, so partners should acquire their own coverage. The expenses and benefits of various Medigap policies depend upon the insurance coverage business. When it comes to valuing Medigap plans, insurance coverage service providers might make use of one of a number of approaches: Premiums are the exact same no matter of age. When a person starts the plan, the insurance policy supplier factors their age into the costs.

Medicare Graham Fundamentals Explained

The insurance provider bases the initial premium on the look at these guys individual's existing age, but costs rise as time passes. The price of Medigap prepares differs by state. As noted, costs are reduced when an individual acquires a plan as soon as they reach the age of Medicare eligibility. Private insurance business may likewise provide discounts.

Those with a Medicare Advantage strategy are disqualified for Medigap insurance coverage. The time might come when a Medicare strategy holder can no more make their very own decisions for reasons of mental or physical wellness. Prior to that time, the person should designate a trusted person to function as their power of lawyer.

The individual with power of attorney can pay costs, data taxes, accumulate Social Safety benefits, and pick or transform medical care strategies on behalf of the guaranteed individual.

The Single Strategy To Use For Medicare Graham

Caregiving is a demanding task, and caregivers commonly invest much of their time fulfilling the demands of the person they are caring for.

Depending on the specific state's laws, this might include hiring relatives to provide treatment. Considering that each state's guidelines differ, those seeking caregiving payment must look into their state's requirements.

The 2-Minute Rule for Medicare Graham

The insurance provider bases the original premium on the person's current age, but premiums rise as time passes. The price of Medigap plans varies by state. As noted, prices are lower when a person buys a policy as soon as they get to the age of Medicare eligibility. Individual insurance companies may likewise provide discount rates.

Those with a Medicare Advantage strategy are disqualified for Medigap insurance policy. The time may come when a Medicare plan owner can no more make their very own choices for reasons of mental or physical wellness. Prior to that time, the individual must assign a trusted individual to serve as their power of lawyer.

See This Report on Medicare Graham

The person with power of lawyer can pay bills, data tax obligations, collect Social Safety advantages, and select or alter healthcare plans on part of the insured individual.

Caregiving is a demanding job, and caregivers commonly invest much of their time satisfying the needs of the person they are caring for.

Report this page